Related Posts

You are about to leave Risk Strategies website and view the content of an external website.

You are leaving risk-strategies.com

By accessing this link, you will be leaving Risk Strategies website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Risk Strategies website. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of Risk Strategies.

Passed in 2003 and effective on January 1, 2006, the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) established Medicare Part D and, for the first time, provided an outpatient prescription drug benefit for the 43 million Americans enrolled in Medicare. Legislators included several risk-abating mechanisms to ensure the stability of the program, including a federal reinsurance program. While this federal reinsurance program has been effective in providing stability, its cost has become unsustainable.

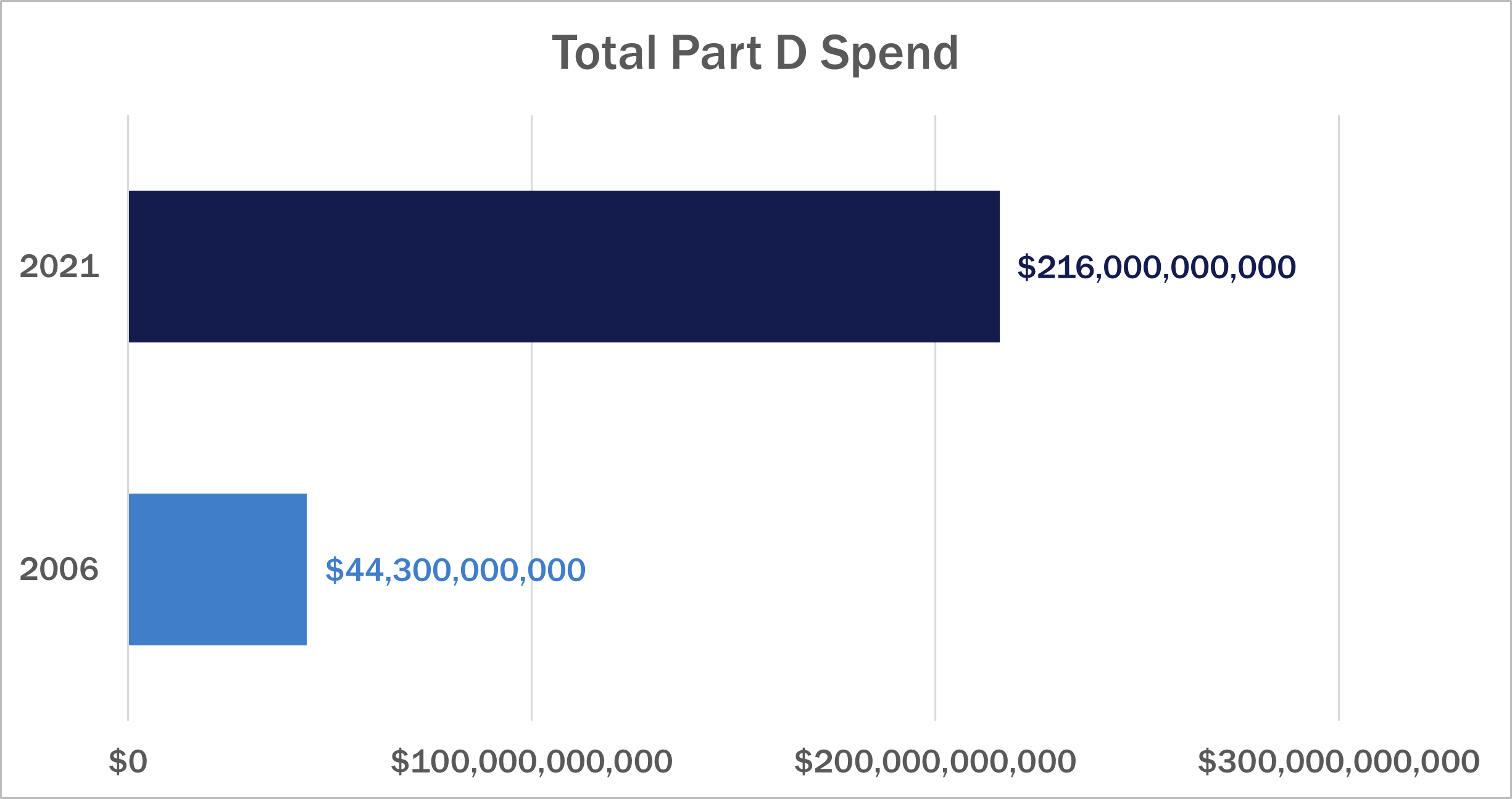

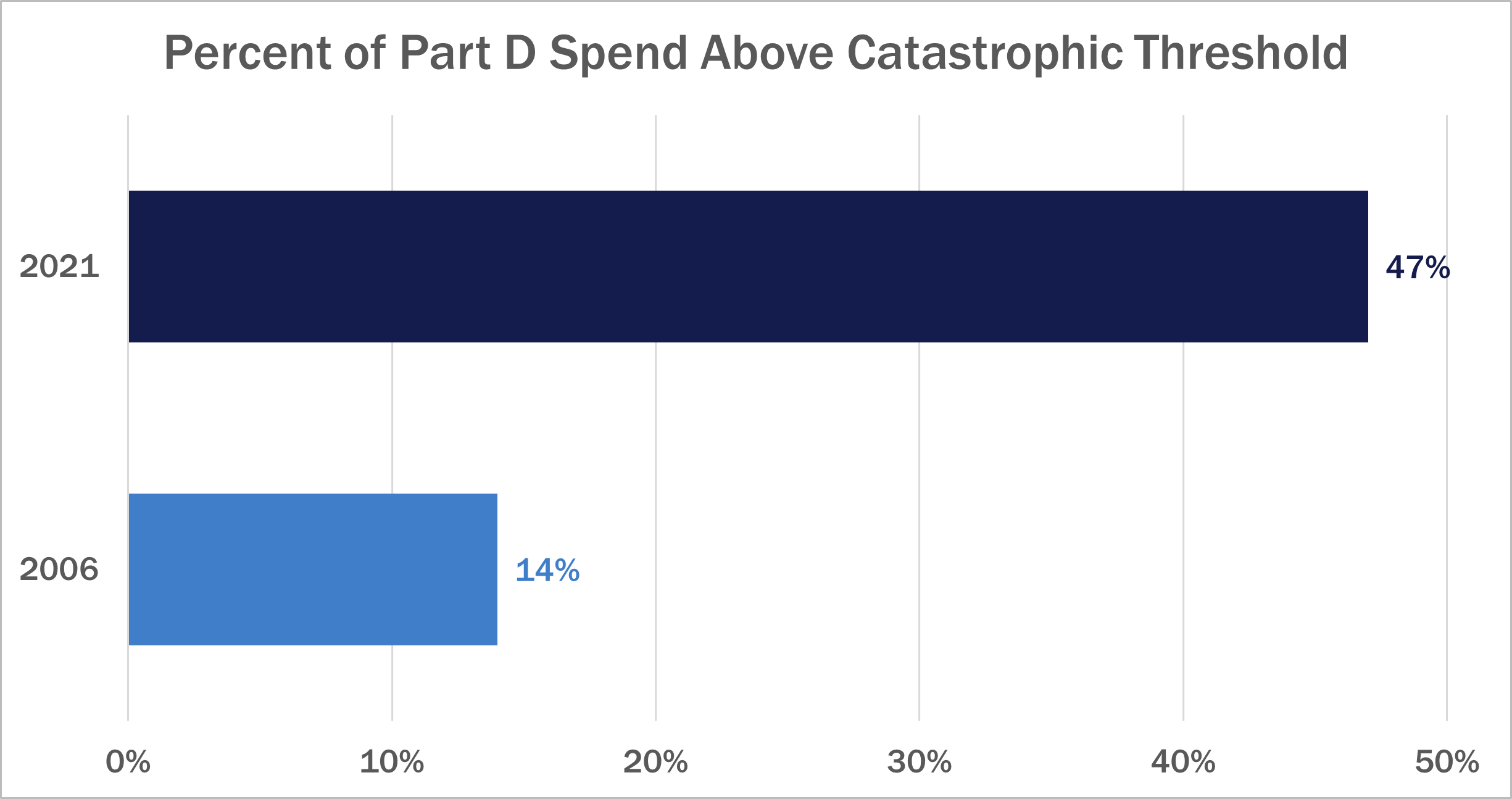

In 2006, total spend on Part D was $44.3 billion. The reinsurance threshold, or catastrophic phase, was set at $3,600 to limit enrollee out-of-pocket spending. The percentage of total Part D spend above that threshold was only 14%. All of these costs have increased at an alarming rate over time.

In 2021—the most recent year for which comprehensive data is available—the threshold was $6,550. Total spend had grown to $216 billion, creating a greater financial burden for taxpayers. The catastrophic phase accounted for close to 50% of those expenses.

For several years, the Centers for Medicare and Medicaid Services (CMS) sought to address this growing budgetary issue. In 2019, lawmakers proposed changes, and in 2022, they wrote the finalized changes into law as part of the Inflation Reduction Act.

Set to take effect over the next few years, these adjustments will lower enrollee prescription costs and reduce federal spending. Healthcare plans and drug manufacturers will begin to pay a larger share of prescription costs in the catastrophic phase. This is good news for enrollees, but it may leave healthcare plans wondering how they will manage the added costs. Here are the upcoming changes to catastrophic coverage under Part D, and how healthcare plans can prepare.

Medicare will roll out the changes to Part D’s catastrophic phase over a two-year period. The initial changes in 2024 will be fairly modest and healthcare plans should be well positioned to digest them. In 2025, the impact on plans will be far more significant.

In 2024:

In 2025:

.jpg?width=1472&height=1304&name=Medicare%20Part%20D%20Charts%20copy%20(1).jpg)

The proposed changes will represent a significant increase in financial liability and risk for all Part D plans and any downstream risk takers. In 2025, Part D plans will face a 400% increase in liability in the catastrophic layer compared to all preceding years.

Part D plans can pursue other reinsurance options to limit volatility. Any Medicare Advantage (Part C) plans are encouraged to review their existing reinsurance programs for Part D and prescription drug exclusions. These exclusions were commonplace in the past because of the generous catastrophic reinsurance provided by Medicare but are no longer appropriate for most Medicare Advantage plans. When discussing renewals, it’s important to ensure no such exclusions are written into the policy.

Plans that work with experienced reinsurance professionals to assess their increased risk and establish risk management measures like reinsurance will be in the best position to navigate these regulatory changes. The same holds true for any healthcare organization participating in a value-based care arrangement.

All Medicare Advantage and Part D plans will benefit from closely examining their exposure to these changes. Making necessary adjustments as soon as possible can prevent your organization from being caught flat-footed as these changes roll out.

Want to learn more?

Find Tracy Hoffman on LinkedIn, here. Find Matt Smith on LinkedIn, here.

Connect with Risk Strategies Managed Care team at healthcare@risk-strategies.com

Connect with Risk Strategies Reinsurance team at reinsurance@risk-strategies.com

The contents of this article are for general informational purposes only and Risk Strategies Company makes no representation or warranty of any kind, express or implied, regarding the accuracy or completeness of any information contained herein. Any recommendations contained herein are intended to provide insight based on currently available information for consideration and should be vetted against applicable legal and business needs before application to a specific client.